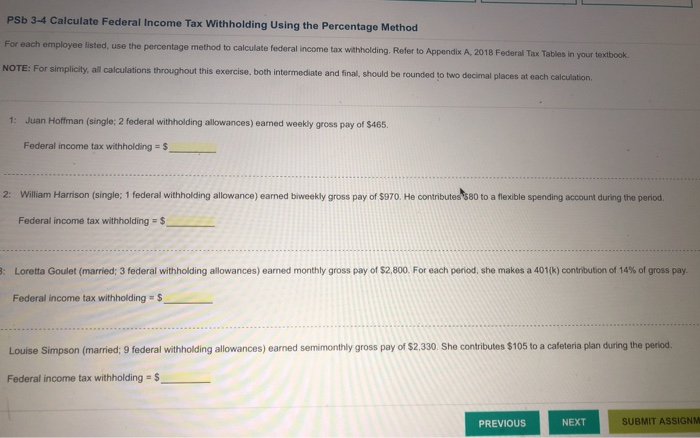

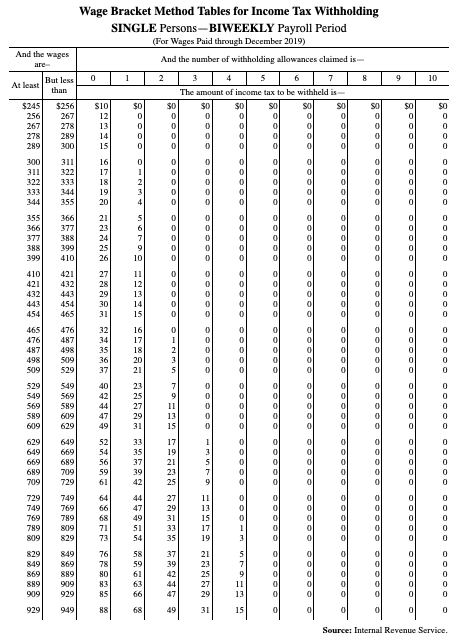

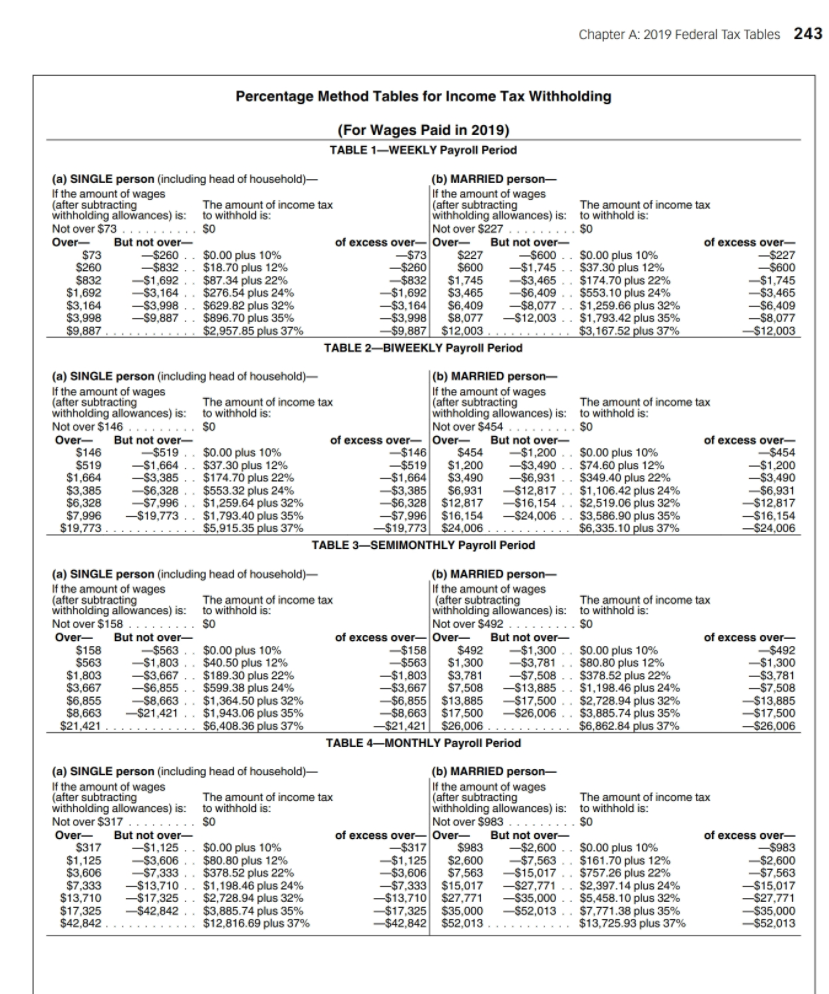

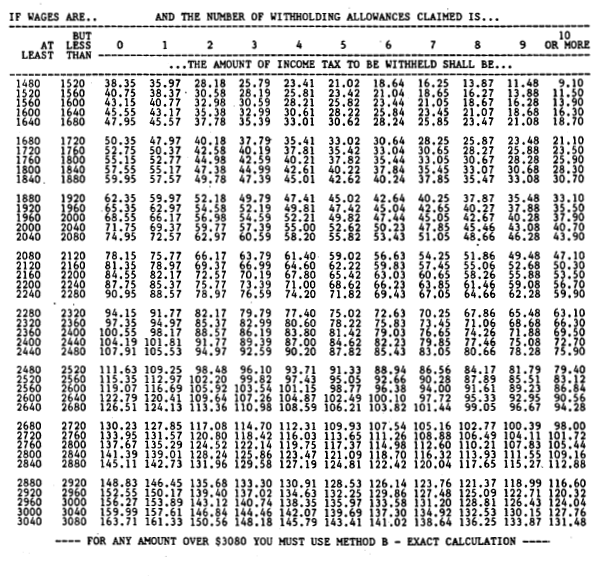

Calculate federal tax withholding biweekly

Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. How to Calculate and Adjust Your Tax Withholding.

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

For example if you received a tax refund eg.

. Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for purposes of computing the State income tax. 15 Employers Tax Guide and Pub. 51 Agricultural Employers Tax Guide.

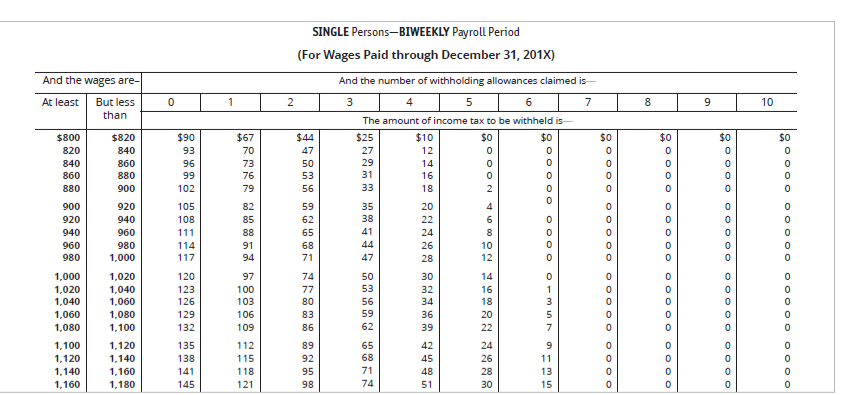

Ready to get your tax withholding back on track. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. In addition to income tax withholding the other main federal component of your.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Subtract the value of the allowances from your biweekly pay. Complete a new Form W-4 Employees.

Minnesota taxes are calculated using the Minnesota Withholding Tax Tables pdf. The amount of income tax your employer withholds from your regular pay. Our online Weekly tax calculator will automatically work out all your deductions based on your Weekly pay.

Based on the number of. The Best Way To Track Expenses Is Using an Easy Powerful Automated App. Subtract your Standard and Estimated deduction amounts from gross pay.

1400 take that refund amount and divide it by the. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Subtract any other pretax contributions.

The tax calculator provides a full step by step breakdown and analysis of each. For employees withholding is the amount of federal income tax withheld from your paycheck. You find that this amount of 2025 falls.

If you claim the same number of allowances for both state and federal taxes you can use the federal Form. This publication supplements Pub. Total Up Your Tax Withholding.

Feeling good about your numbers. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Ad Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Ad See the Tax Tools your competitors are already using - Start Now. So S - F Adjusted Taxable income for Iowa. We suggest you lean on your latest tax return to make educated withholding changes.

Calculate the withholding tax using the appropriate section below. Take these steps to fill out your new W-4. In this example you would subtract 42114 from 1900 to get 147886.

Change Your Withholding. It describes how to figure withholding using the Wage. Calculating Your Federal Withholding Tax To calculate your federal withholding tax find your tax status on your W-4 Form.

Discover Helpful Information And Resources On Taxes From AARP. GetApp has the Tools you need to stay ahead of the competition. To change your tax withholding use the results from the Withholding Estimator to determine if you should.

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Psb 3 4 Calculate Federal Income Tax Withholding Chegg Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Income Tax

Solved Note Use The Tax Tables To Calculate The Answers To Chegg Com

Paycheck Calculator Take Home Pay Calculator

For Each Employee Listed Use The Percentage Method Chegg Com

How To Calculate Payroll Taxes Methods Examples More

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Verify Taxes Withheld Procare Support

395 11 Federal State Withholding Taxes

2

Payroll Tax What It Is How To Calculate It Bench Accounting

Solved Compute The Net Pay For Each Employee Using The Chegg Com

Calculating Federal Income Tax Withholding Youtube

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services